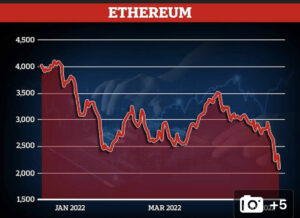

The world’s second largest cryptocurrency Ethereum has joined the cryptocurrency crash – plummeting in value by 20 per cent over the last 24 hours – as the digital currency downturn hammers investors who bought during the Covid years.

Cryptocurrencies have sharply declined in value during the past few days as fears for the global economy spread and investors start to sell off risky assets.

However investors in more traditional stocks are also hurting, with US tech stocks also plunging in recent weeks including Amazon which has fallen 30 per cent in a month.

Many amateur investors took to buying stocks and digital currencies during the Covid pandemic and made money because values were generally rising in a so-called bear market.

Ethereum has now lost more than half of its value this year, Bitcoin has shed a third of its value since January and Luna with 98 per cent of its value wiped out overnight with suicide hotlines pinned to the currency’s Reddit page as a result.

Popular digital currency exchange Coinbase warned users could lose all of their money if the company goes bankrupt – after the downturn led to a 27 per cent fall in its share price.

During the pandemic, record low interest rates intending to boost economies led to investors buying riskier assets like cryptocurrency with higher rates of return.

As skyrocketing inflation leads to a rise in interest rates in order to safeguard savings, these assets are being sold in favour of safer government bonds – which will provide better returns.

The Bank of England pushed up interest rates by 0.25 per cent to a 13-year high of 1 per cent on May 5.

The Federal Reserve also raised their interest rates to 1 per cent on May 4 – with further rises expected to fend off the worst effect of inflation.

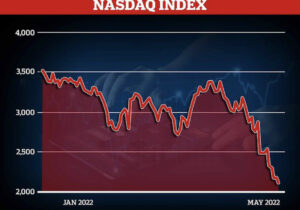

The NASDAQ experienced its sharpest one-day fall since June 2020 earlier this week and the crypto hit implies an increasing integration between crypto and traditional markets.

The index which features several high-profile tech companies, finished May 5 trading at $12,317.69 with shopping sites such as Etsy and eBay driving the fall.

The two companies saw their values drop 16.8 per cent and 11.7 per cent respectively, after announcing lower than expected revenue estimates.

Previously high-flying tech stocks have begun to dramatically fall in value in recent months – fuelling fears of a broader economic crash and making investors less likely to purchase assets.

Elon Musk’s Tesla has fallen 36 per cent in the last month amid news of the eccentric CEO’s attempts to buy Twitter.

The electric car manufacturer is now trading at £600, a dramatic drop from £937.69 a month ago.

Delivery giant Amazon saw a 30 per cent drop on its price since April 11 with the stock hitting £1725.19 today – down from £2468.75.

The fall of these stocks are fuelling fears that the ‘dotcom bubble burst’ of the early 2000s could be about to repeat.

In the late 1990s, the increase in computer and internet access led to large scale speculative trading in internet companies.

The interest resulted in companies with a ‘.com’ suffix being valued very highly.

After the US Federal Reserve increased interest rates after the end of the 1990s boom, speculative trading dipped and caused the dotcom bubble to burst, sending values plummeting.

The amount of business done by crypto exchanges, which hold the ‘blockchain’ ledgers that record transactions, is already dropping heavily.

‘The crypto sell-off has been driven by the daunting macro backdrop of rising inflation and interest rates that has sent shockwaves through the tech sector, dragging cryptos down with it, confirming that Bitcoin and others serve little purpose as a hedge against inflation,’ said Victoria Scholar, head of investments at Interactive Investors.

Popular cryptocurrency Luna lost its pegging to the dollar this week, falling below $1 per coin, causing prices to drop dramatically as the industry panicked (similar to a run on a bank).

The coin, also called Terra, lost 98 per cent of its value overnight.

‘The Terra incident is causing an industry-based panic, as Terra is the world’s third-biggest stable coin,’ said Ipek Ozkardeskaya, a senior analyst at Swissquote Bank.

But TerraUSD ‘couldn’t hold its promise to maintain a stable value in terms of U.S. dollars.’

The crypto downturn has wiped more than $1.5trillion of value from the markets but investors will still be hoping that prices will be able to recover as they have done in the past.

However, unlike previous crashes, experts think that this latest drop in prices could prove permanent due to broader fears about global recession

Bitcoin hit and then-high of £16,194.81 on December 17, 2017 before falling below £9,000 just five days later – losing nearly 45 per cent of its peak.

The price recovered to pre-crash levels in November 2021.

The downturn has led to Coinbase, an online trading platform, issuing a stark warning to customers: Your crypto is at risk if the exchange goes bankrupt.

The popular exchange has seen its value drop 27 per cent as a result of the crash.

According to Coinbase’s official website, the company has more than 98 million verified users. It is the largest cryptocurrency exchange platform in the United States.

Coinbase’s CEO Brian Armstrong attempted to calm shareholders in a series of tweets one of which read: ‘Your funds are safe at Coinbase, just as they’ve always been.’

Despite Armstrong’s claims, in an SEC filing the company referred to customers as ‘unsecured creditors’ in the event that Coinbase went belly-up.

This means that customers’ crypto assets would be considered the property of Coinbase by bankruptcy administrators.

The SEC filing, Staff Accounting Bulleting 121, requires crypto platforms to include customer’s crypto holdings as assets and liabilities on balance sheets.

Armstrong wrote on Twitter that the company is at ‘no risk of bankruptcy’ despite the filing, which he said was made so that company would be in compliance with SEC regulations.

source:dm